irs tax levy calculator

For employees withholding is the amount of federal income tax withheld from your paycheck. How to Calculate Wage Tax Levy.

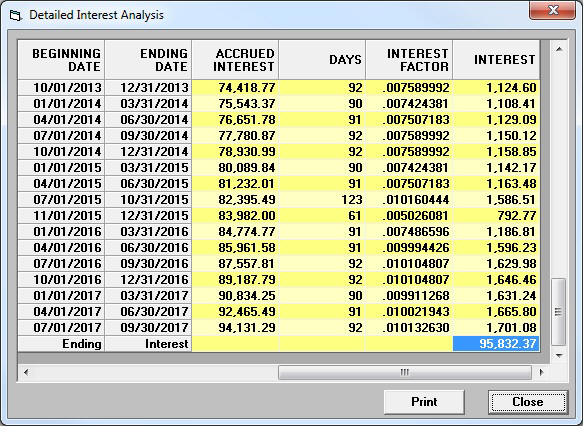

Irs Interest Penalty Calculator Uses Supported Penalties Reviews Features

It is different from a lien while a lien makes a claim to your assets as.

. The information you give your employer on Form W4. This IRS penalty and interest calculator provides accurate calculations for the failure to file failure to pay and accuracy-related. Use the IRS Circular Es tax withholding tables to calculate federal income tax.

Employers generally have at least one full pay period after receiving a notice of levy on wages to begin withholding the required. If you have a tax debt the irs can issue a levy. A tax levy is a.

You can use the Tax Withholding Estimator to. The IRS can garnish wages take money from your bank account seize your property. For employers and employees - Use the calculator to determine the correct withholding amount for wage garnishments.

Part of your wages. You have nonresident alien status. Thus the combined penalty is 5 45 late filing and 05 late payment per month.

By using this site you agree to the use of cookies. You will need a copy of all. When the levy is on a bank credit union or similar account the Internal Revenue.

A tax levy is a legal process that the IRS takes in order to seize the money you owe in taxes. File your tax return on time. The IRS can take as much as 70 of your.

I have an employee who has a 2100 tax levy as of 032007s notice. A tax levy is a legal seizure on wages to satisfy a tax debt. A single taxpayer who is paid weekly and claims three dependents has 50290 exempt from levy.

Use Notice 1392 Supplemental Form W-4 Instructions for Nonresident Aliens. If the percentage is 15 enter 15 as a decimal. An IRS levy permits the legal seizure of your property to satisfy a tax debt.

Information About Wage Levies. This calculator computes federal income taxes state income taxes social security taxes medicare taxes self-employment tax capital gains tax and the net investment tax. The levy is released.

Tax changes as a result of the Tax Cuts and Jobs Act have altered the way employers. Irs tax levy calculator. I have an employee who has a 2100 tax levy as of 032007s notice.

If the IRS levies seizes your wages part of your wages will be sent to the IRS each pay period until. If you have a tax debt the IRS can issue a levy which is a legal seizure of your property or assets. As an employer when you receive a notice of levy from the federal government youll need to calculate the amount of the employees pay that.

If the taxpayer in number 1 is over 65 and writes 1 in the ADDITIONAL STANDARD. Calculate Social Security tax at 42 percent of gross income and Medicare tax at 145 percent as of 2011. The maximum total penalty for both failures is 475 225 late filing and 25 late payment.

Enter the percentage from section 2 b 1 of the Wage Garnishment Order may not exceed 15. Irs tax levy calculator. Estimate your tax withholding with the new Form W-4P.

The IRS can levy or legally seize a taxpayers property to satisfy an outstanding back taxes. The IRS provides a wage garnishment calculator to determine the correct amount of wages to be withheld from an employees paycheck. For help with your withholding you may use the Tax Withholding Estimator.

Irs Penalty Calculator Infographic Tax Relief Center

Know These 5 Warning Signs Of An Irs Levy

Know 5 Faqs About The Irs Bank Levy Process Blog

Top 10 Tips For Filing Irs Tax Returns In 2014 Defense Tax Partners

Who Do I Call About An Irs Tax Levy

The Tax Relief Blog Testimonials Precision Tax Relief

Tax Penalty Interest Assistance Tax Penalty Lawyer Columbus Oh

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Why You Shouldn T Take That Irs Withholding Calculator At Face Value

2021 Estate Income Tax Calculator Rates

Irs Levy Tax Matters Solutions Llc

Irs Letter 1058 Or Lt11 Final Notice Of Intent To Levy H R Block

Can The Irs Take Money From Your Bank Account Bell Davis Pitt

Understanding Irs Tax Levies And Garnishments

Does The Irs Forgive Tax Debt After 10 Years

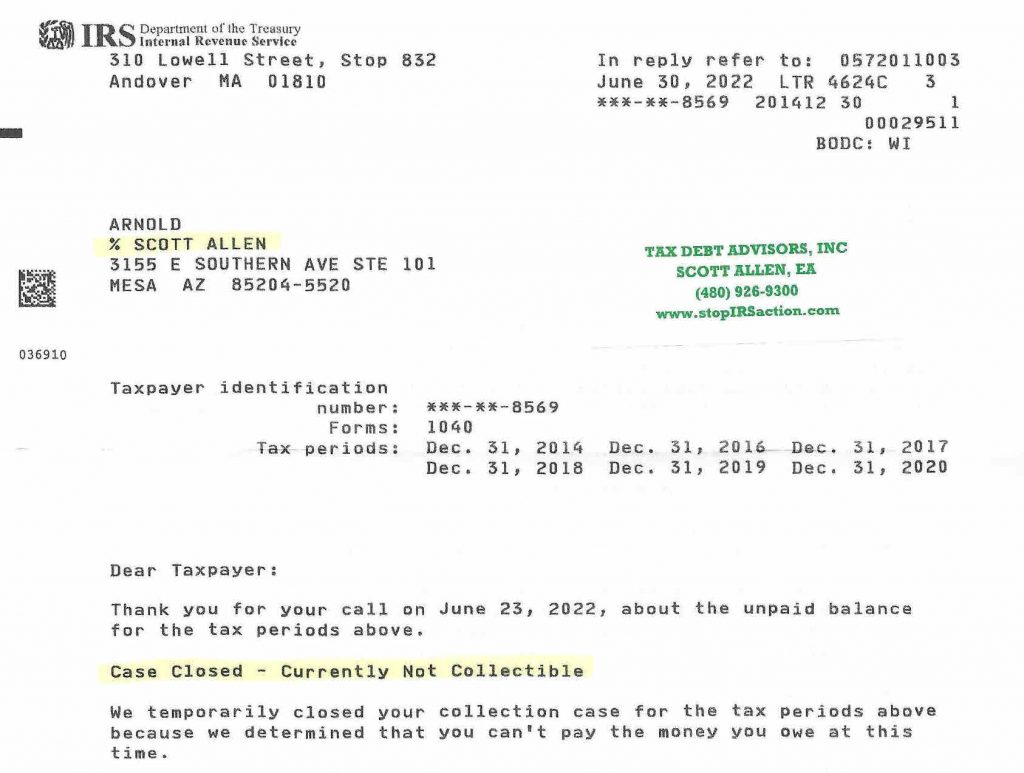

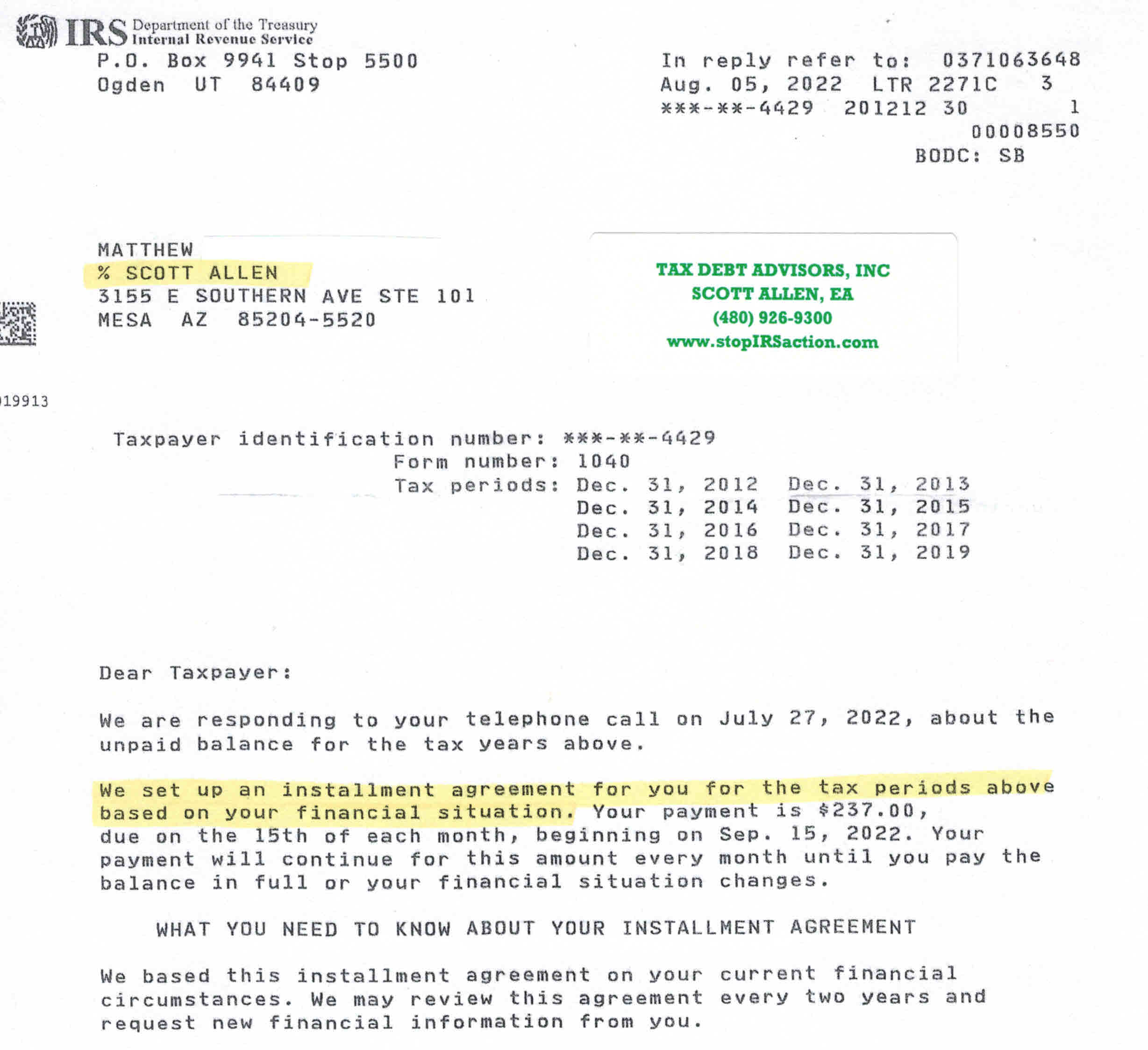

Irs Tax Lien Problems Tax Debt Advisors

Irs Tax Attorney Tax Debt Advisors

Video Irs 1099 Levy Contractor Options Turbotax Tax Tips Videos