b&o tax seattle

If you do business in Seattle you must. You can deduct revenue from the sale of tangible goods or retail services when you deliver them to another part of Washington outside Seattle.

In addition retail sales tax must also be.

. You need to report the income of such sales under this classification. The BO tax rate is 0275 percent. Extracting Timber Extracting for Hire Timber.

The BO tax is calculated based on gross business receipts less. 7386494 or more of payroll expense in Seattle for the past calendar year 2021 and. See also Wholesaling of Solar Energy on this page.

Related

3 In 2006 KMS successfully defeated an effort by Seattle to impose a BO tax. This table below summarizes Seattle business license tax rates and classifications. It is sometimes called the Seattle business and occupation tax BO tax or gross receipts tax.

Dann Mead Smith president of the Washington Policy Center says the BO is hard to kill for several reasons. Washington unlike many other states does not have. The City of Seattle Department of Finance and Administrative Services will defer business and occupation BO tax collections for businesses that have annual taxable incomes of 5.

No deduction is allowed for labor. It applies to the gross income of the business. Extracting Extracting for Hire.

Customer Service Service is available on the 4th floor of the Seattle Municipal Tower 700 Fifth Ave by appointment only Tuesdays and Wednesdays 830 am. Seattles BO tax is generally imposed on all persons engaging in business activity within the city. Box 34214 Seattle WA 98124-4214 Phone.

The Retailing BO tax rate is 0471 percent 00471 of your gross receipts. Requires the business to file an Annual Tax Performance Report. Specialized BO tax classifications.

700 Fifth Ave 4th Floor Seattle WA 98104 Mailing Address. The state BO tax is a gross receipts tax. Entities engaging in business inside the Seattle city limits are required to pay a business and occupation BO tax.

Identify each city you deliver to. The BO tax is a gross receipts tax assessed against an entity for conducting business in Washington. It is measured on the value of products gross proceeds of sale or gross income of the business.

Call 206-922-8078 for a free consultation. The payroll expense tax in 2022 is required of businesses with. First the most likely alternative is an income tax which would ahave a.

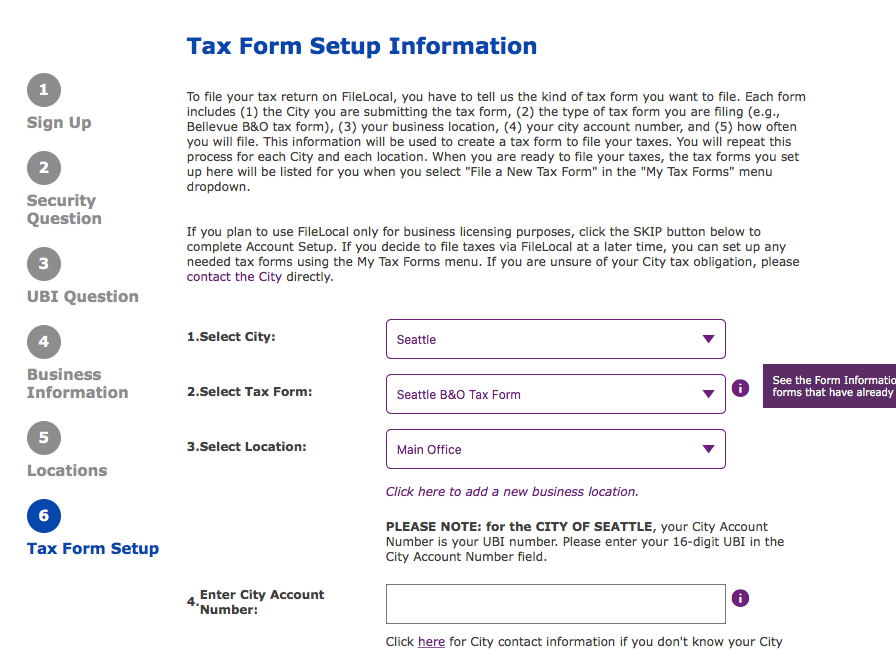

The Seattle tax law attorneys at Insight Law handle all Washington State Business and OccupationBO Tax Audit Issues. In the interest of brevity we will center this section around the city of Seattle which uses the FileLocal website for BO taxes though several nearby cities also use the FileLocal. If your business is a retail store and you are filing a local tax return for 2017 the.

Have a Seattle business license see the.

Advocacy Update July 2018 Aia Seattle

A Progressive City Should Have Progressive Taxes South Seattle Emerald

Who Really Pays Economic Opportunity Institute Economic Opportunity Institute

Business And Occupation Tax Credit Commute Seattle

Business License Fees And B O Taxes Going Up

Testimony Washington S Business Tax Structure Tax Foundation

Current Covid 19 Related Tax Guidance For Oregon Washington And California Kbf Cpas

Double Duty How Startups And Small Businesses Could Be Hit Twice Under Seattle S New Income Tax Geekwire

Vancouver City Council Tosses B O Tax Proposal The Columbian

Auburn Studies First Draft Of Proposed B O Tax Auburn Reporter

Breakdown Seattle City Council Gets Some Bad Budget News Seattle Business Magazine

15 Business Finance Tips Yg Ideas Business Finance Finance Tips Financial Advice

Advocacy Update May 2019 Aia Seattle

Focus On Washington Miles Consulting Group

For First Time Boeing Reveals State Tax Breaks 305 Million In 2015 The Seattle Times

B O Tax Annual Report To Seattle Seattle Business Apothecary Resource Center For Self Employed Women

Seattle Now Has The Right To Levy A 1 Income Tax The Urbanist

How Washington S New Workforce Education Surcharge Applies To Law Firms Skepsis Technologies